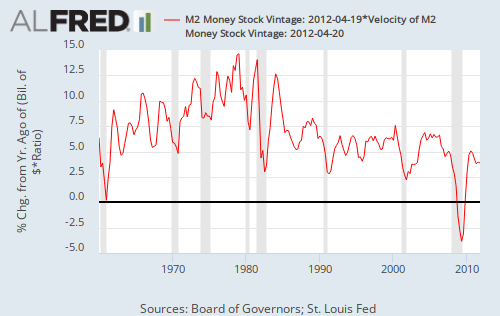

You'll note that it grew rapidly in the 1970s, resulting in inflation (as expected). However, it dropped significantly during the recession and is still growing only modestly, thus suggesting that inflation is not a threat at this time.

What happens when banks start lending those excess reserves? Excess reserves declined by $100 billion in the second half of 2011, but have since stabilized. If banks start loaning large amount of excess reserves, the money supply will begin to expand rapidly and inflation becomes a threat. That's why it's critical for the Fed to have an exit strategy (which Ben Bernanke has explained on repeated occasions; for example, click here). Having a strategy and executing it well is easier said than done. In the mid-2000s, the Japanese central bank implemented QE and then withdrew it without igniting inflation, so it can be done. On the flip side, how likely is QE3? Bernanke has stressed that the primary rational for QE1, QE2, and a possible QE3 is to avoid deflation. A sluggish recovery with moderate inflation doesn't justify QE3. Barring another perceived (or actual) threat of deflation, QE3 would seem to be unlikely.

What's happening with bank lending? Here's a table that traces bank lending in its many forms. Commercial and industrial loans rebounded nicely in 2011, but real estate and consumer loans continue to languish.

The principles of monetary policy that existed prior to the Great Recession still appear to hold true. Given that the money supply is not expanding at a rapid rate by historical standards and given that there's no chase, inflation is not a threat in the near term. If conditions change and the Fed sits idly by, inflation could be an issue down the road, but this is unlikely to occur. Executing the exit strategy will be difficult (too soon could stifle the recovery, too late could lead to higher inflation than desired), but chances are the mistake is likely to be relatively small, making high inflaiton unlikely. On a related not, break-even inflation according to the TIPS market is 1.91% over the next 5 years and 2.19% over the next decade, suggesting that financial markets are not concerned about inflation any time soon.