You'll note that, after surging at the end of the recession/early in the recovery in 2009, productivity has stagnated in recent years. In fact, from the beginning of 2011 to the end of the second quarter of 2013, productivity growth has averaged -0.3% (reaching a record low of -1.1% in the summer of 2011). Historically, the only time productivity growth tends to be negative is right before or during a recession. The optimists will point out the one exception: 1993-1995, which preceded the boom of the late 1990s.

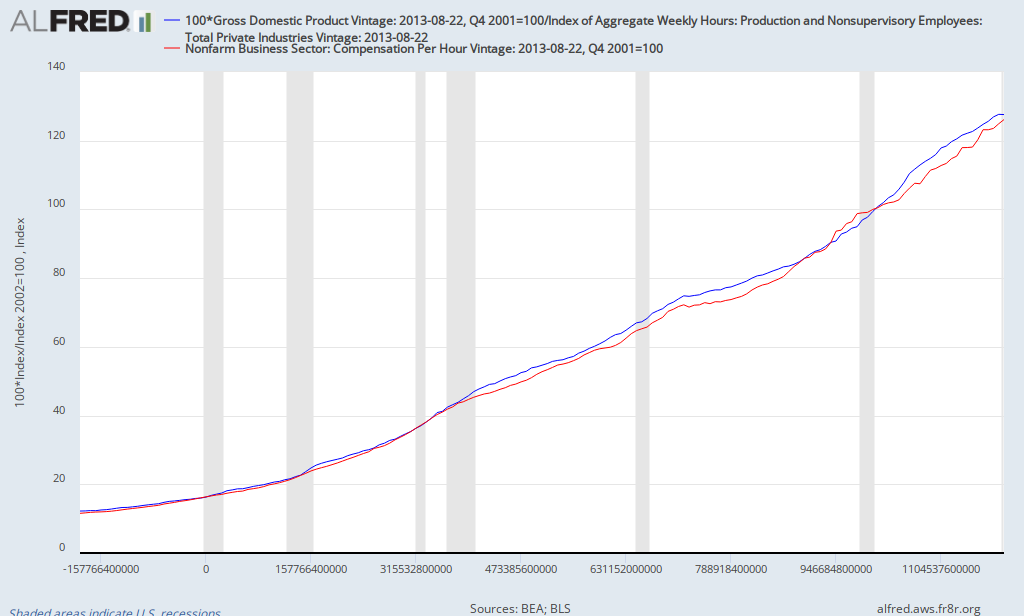

From an economic point of view, it's hard to be excited about an economy that is growing at a modest pace accompanied by stagnant productivity. Historically, there's been a strong correlation between productivity and compensation (income plus fringe benefits earned by workers) as illustrated by the chart below (blue line is productivity and red line is compensation):

The poor performance of productivity in recent years suggests that one shouldn't expect significant improvements in average compensation (and thus the standard of living) in the near future.