One of the biggest debates in the blogosphere and political world concerns growth vs. austerity, both for Europe and the United States. Advocates of austerity generally cite a few key points in supporting their perspective. First, deficits and debt are harmful, particularly in the current European context. In order to maintain credibility and be able to continue to borrow in finanical markets, governments must demonstrate that their budget deficits and national debt are under control. If investors perceive that their money is at risk, they will demand higher interest rates before purchasing government bonds. That is why interest rates on Greek bonds are so high, but also why Spanish and Italian long-term government bonds currently have yields of about 6% (compared to less than 1.5% in Germany). Other advocates of austerity present an argument that relies on the view that private spending is more efficient than government spending. While many economists support this perspective overall, some advocates of austerity go so far as to state that significant cuts in government spending can actually lead to more growth in the short run (hard to support from an economic perspective). Others point out the perceived ineffectiveness of the Obama stimulus plan as evidence that spending and/or temporary tax cuts do little to stimulate economic growth.

Most of those who advocate "growth-oriented" policies nowadays seem to advocate increased government spending, though some also propose tax cuts (for example, continuation of the payroll tax cut in the US). They point out that austerity (reduced government spending) hurts the economy in the short run and may even lead to higher budget deficits as economies slow down or slip into recession (resulting in less government tax revenue, etc.). Many of the strongest proponents of "growth" policies (for example, Paul Krugman), think that concern about deficits and debt are overblown and priority should be given to stimulating economic growth, particularly in the United States where yields on government bonds are near record lows.

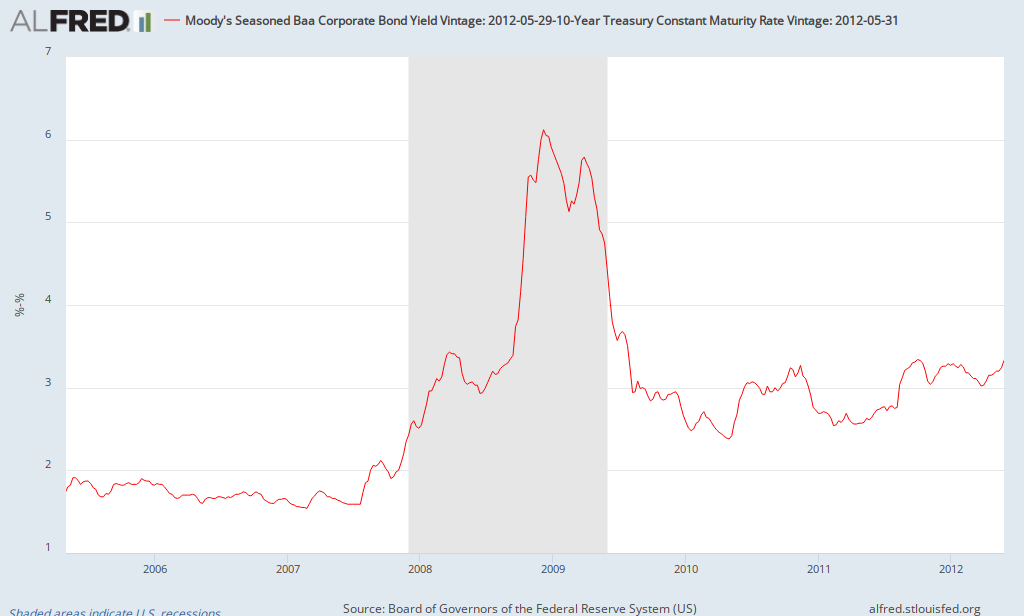

So who's right? As you can guess, there's some merit to both sides. With regard to austerity, financial markets tend to be the judge since they determine the interest rates that must be paid on bonds. The judge has declared that Greece is guilty and is ready to be sentenced (for example, even after being bailed out again late last year, yields on long-term Greek bonds are almost back to where they were prior to the latest bail out). While Greece may be given the death penalty or life in prison, other countries are also being punished, but less severely (Portugal, Ireland, Italy, and Spain). Thus, they would seem to need to engage in some form of austerity unless they can obtain another source of financing. However, the United States'government is facing record low interest rates, so it has more flexibility and time. If it ignores the warning signs, it will eventual be in a similar situation to countries in Europe, but that's down the road. Implementing a policy of long-term austerity should be sufficient to sway the judge. However, the US hasn't come up with a plan that will be implemented any time soon.

What about growth? Ideally, this is the way to go for countries, but two issues arise - what do you mean by growth and does the country have the flexibility to implement growth-oriented policies? As mentioned above, it's too late for Greece unless Europe is willing to provide large amounts of financing for a long period of time. Let's address the first part of the question - what do you mean by growth? Though spending is the major determinant of short-run economic growth, the type of spending is critical in determining the impact on long-term economic growth. A serious criticism of the Obama stimulus plan is that, though it provided temporary support for demand, it did little to promote sustainable economic growth. For example, though social welfare spending can be supported for other reasons, it does little to promote economic growth over time. Spending that results in real improvements in infrastructure, improves human capital (education & skills), etc., provides support for demand in the short run but also enhances long-term economic growth. Policies that reform social spending while also making productive investments in physical and human capital can reduce deficits while promoting growth over time. Similarly, tax reform that eliminates loopholes (sometimes refered to as tax expenditures) while lowering tax rates can enhance economic growth while containing or reducing budget deficits (depending on how many loopholes are eliminated and how much tax rates are reduced). How does tax reform encourage growth? Basically, getting rid of loopholes (preferences) eliminates special treatment for particular activities while lower tax rates increase the after-tax return on investments and other income-generating activities.

The US still has time to implement policies that reduce the budget deficit over time while encouraging sustainable economic growth (tax reform, entitlement reform, investments in infrastructure and education; of course the details matter). Countries in Europe have less leeway and probably have to give a higher priority towards austerity (or growth-enhancing policies that also lead to lower deficits; for example - eliminate relatively more tax preferences combined with modest reductions in tax rates). Austerity does not lead to more economic growth in the short run while real growth is more than temporary measures whose effects dissipate relatively quickly. Austerity without growth-oriented policies do not address the underlying issues faced by those countries struggling through the European financial crisis. It's not a simple debate between growth vs. austerity. Of course there's a lot more to this story (to be addressed in future posts).