Concern over Italian and Spanish debt is more evident when one considers 3-year bonds which, though still below their recent highs in late 2011, have risen significantly in recent months:

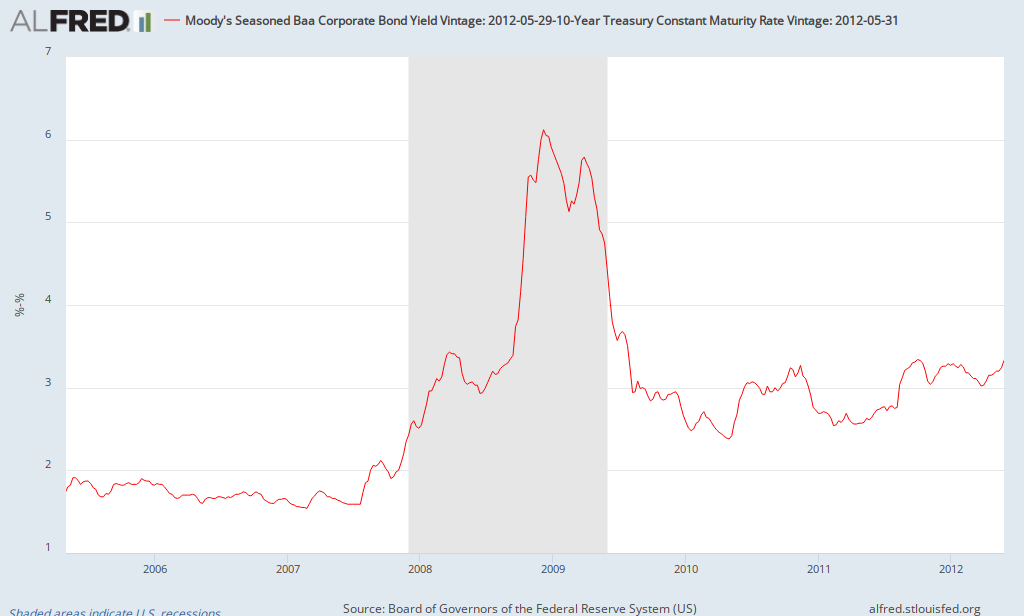

Looking at the US, the risk premium on Baa corporate bonds (investment-grade bonds) is the highest level since July 2009 (3.40% as of May 30).

What difference does this make? It's a measure of how much extra investment-grade (high quality) corporations need to pay to obtain credit relative the the US government. The higher the risk premium, the more difficult it is for corporations to borrow and invest. There's only been one period prior to the Great Recession during which the risk premium was this high outside of a recession (late 2002, in the aftermath of 9/11). The implications are that the US economy will continue to grow slowly at best, if the risk premium remains at this level. The primary concern of economists is that financial contagion from Europe may cause the risk premium to spike, resulting in a recession. As long as the European crisis stays relatively contained, it should only be a drag on the US economy.

It's important to keep an eye on financial markets to see how strong a storm will come from Europe.