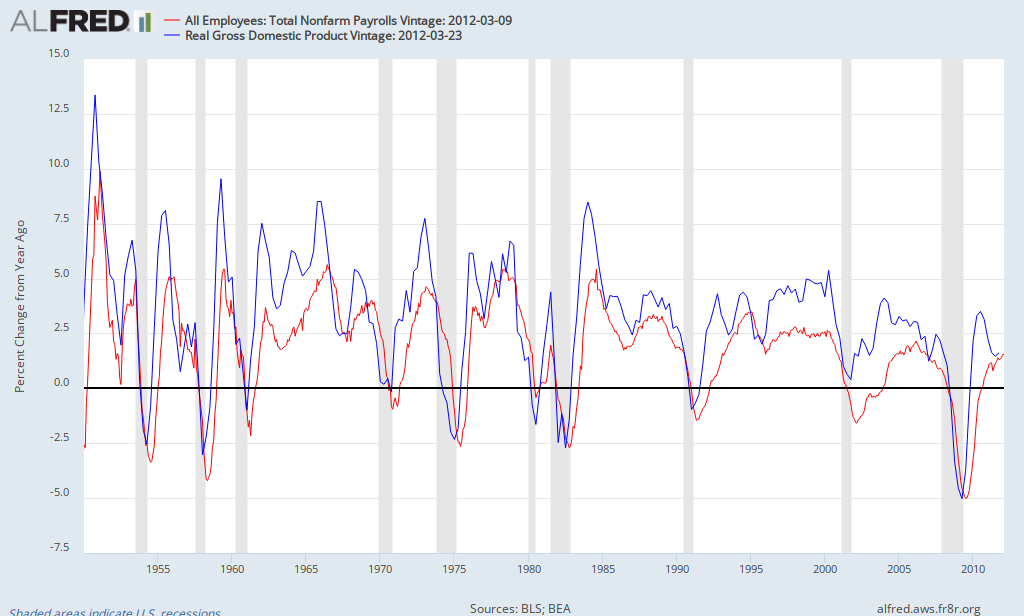

As you can see, the blue line is normally above the red line (economic growth typically exceeds employment growth). With few exceptions, employment growth only exceeds economic growth near the beginning of recessions. Let's look at it from another perspective. Another measure of the job market is the aggregate hours worked. Many economists see this as a more precise gauge of the job market since it not only accounts for the number of jobs, but also how many hours people are working on the job. By taking the ratio of GDP to hours worked, one gets an estimate of productivity (output per hour). The following chart shows the behavior of GDP per hour over time.

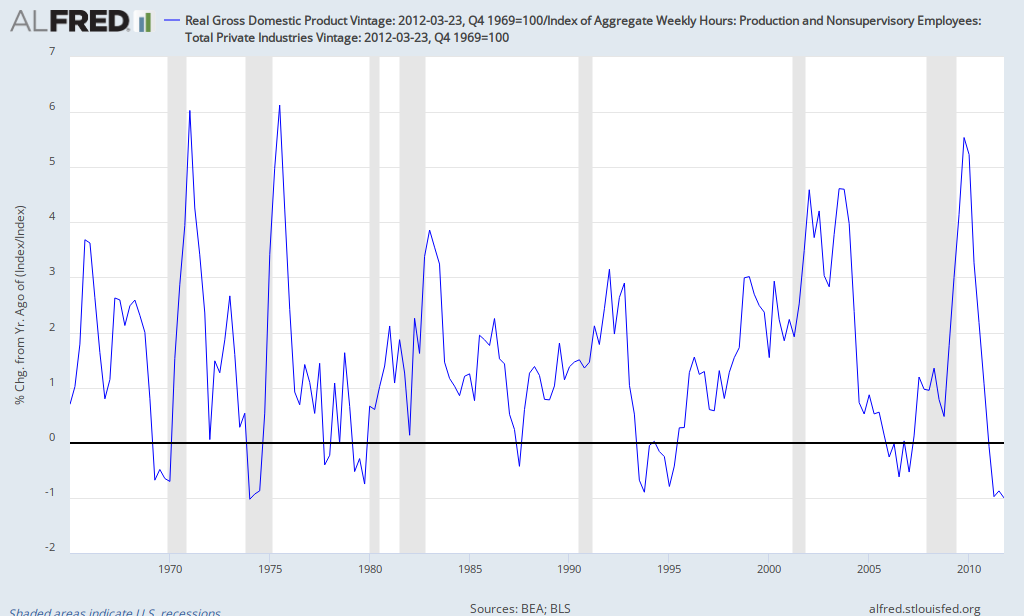

From this chart, it is evident that the current recovery is similar to but also different from past recoveries. When the economy comes out of a recession, GDP per hour typically grows quickly as evidenced by the recoveries of 1970, 1975, 1983, and the current recovery. As the expansion takes hold, the surge typically subsides. The average difference betweem economic growth and employment growth over the period was 1.5% (so when economic growth is 2.5%, employment growth tends to be about 1%). What's different this time is that it didn't just moderate as in the past, but is actually shrinking by 1%, which is lower than virtually any other period since data for hours worked became available (only comparable decline was during the severe recession of 1974, when it also declined by 1%). The only other time in which it shrank without leading to or being in a recession was in 1994.

I'm not predicting a recession, but pointing out that it would be unprecedented for the job market to continue to improve unless economic growth strengthened significantly. Given consensus forecasts of modest economic growth (about 2.5% for 2012), the recent strengthening of the labor market is unlikely to be sustained (current pace would result in about 3 million jobs this year). If employment grew by about 1.5% in 2012, that would still mean a gain of about 2 million jobs. Of course many factors will determine the outcome including the European recession, the slowdown in China, rising gas prices, etc. The key point is that the performance of the job market must eventually reflect what's happening to economic growth.