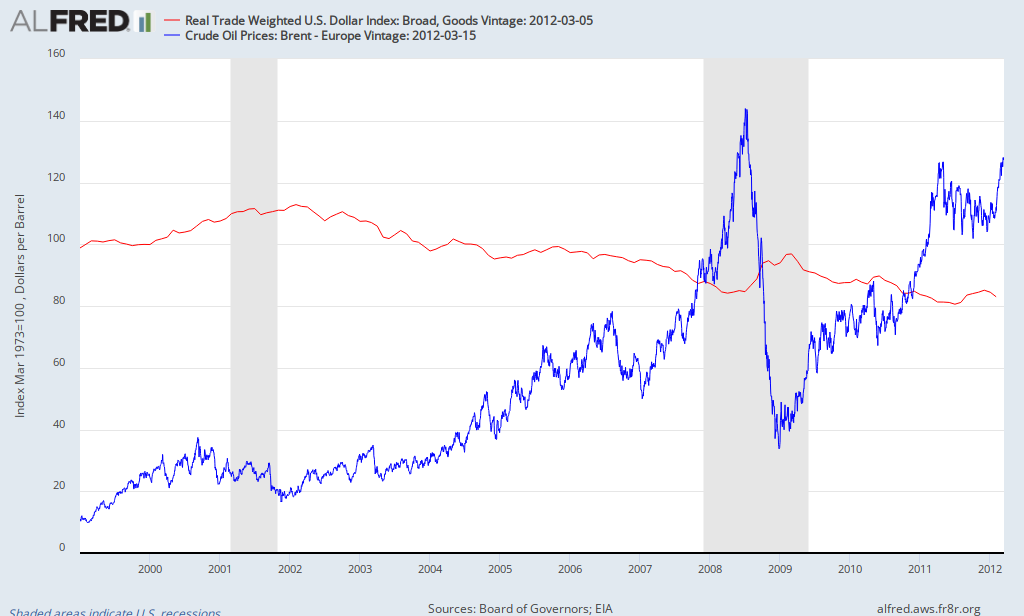

First, here's what happened to the dollar and oil prices since 1999 (blue line is oil, red is the value of the dollar):

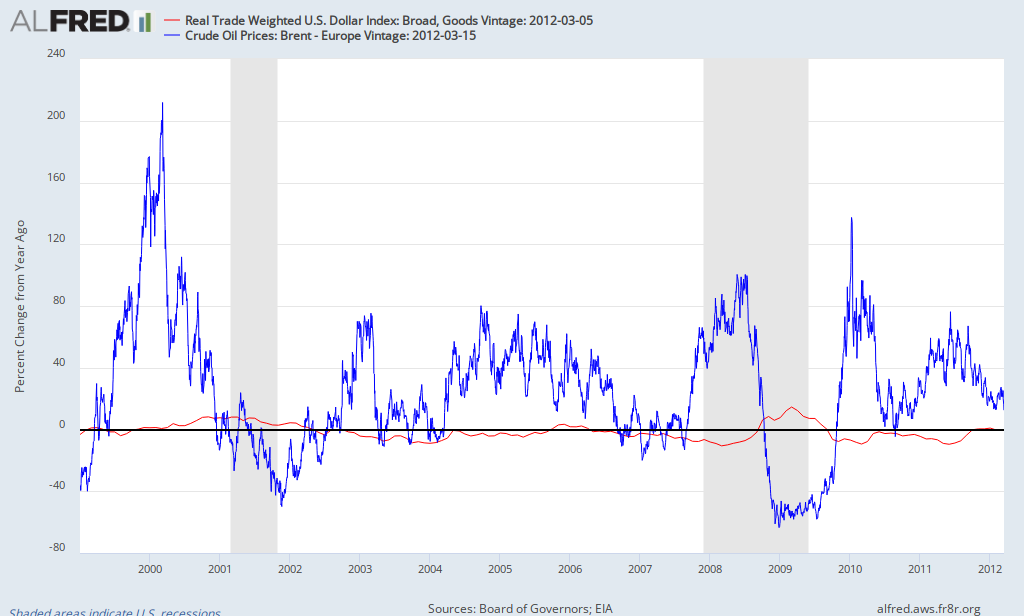

Now here's the percent change in the value of the dollar and oil prices (percent change from one year earlier):

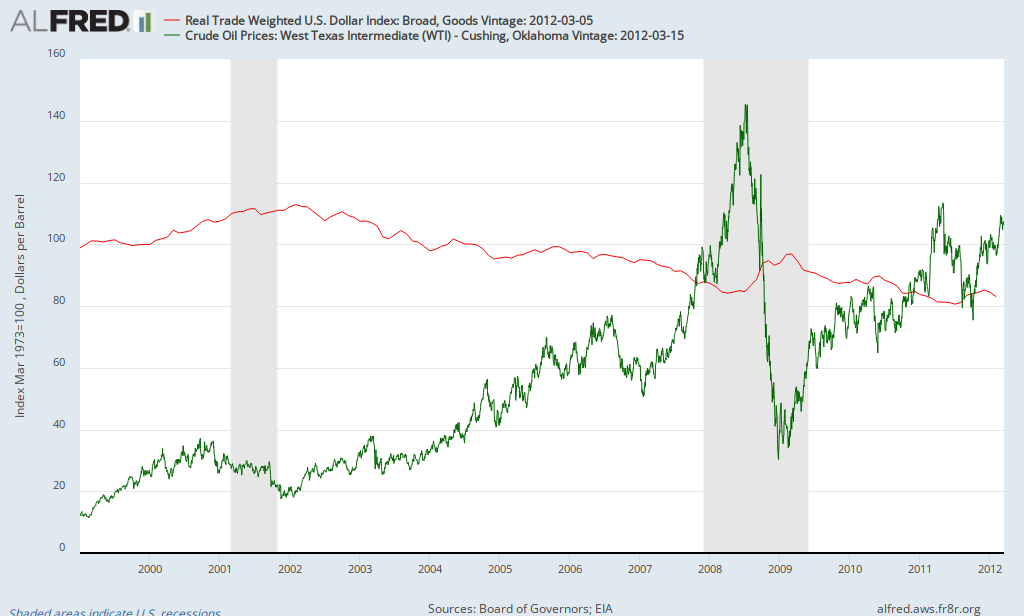

Does it make any difference if one uses West Texas Intermediate instead of Brent (green is oil)?

If you look carefully, you can see a relationship at times, but clearly fluctuations in the oil far exceed that of the dollar. Before we discuss it further, it should be noted that most oil is traded globally in terms of dollars, so a decline in the value of the dollar doesn't directly affect the price of imported oil. However, if the dollar declines in value, since oil is priced in dollars, it becomes cheaper for other countries to purchase, thus increasing the demand for oil elsewhere, putting upward pressure on its price. Speculators may speed up this process as they anticipate these changes.

In addition, some events can cause both the dollar to increase in value and the price of oil to decrease. For example, the financial crisis of 2008 caused global investors to shun risky assets (such as oil), leading to lower oil prices. Investors put their funds in the perceived safest haven, US bonds, causing a significant increase in the demand for dollars, thus increasing its value. Thus, the major event wasn't a stronger dollar reducing the price of oil, but risk-aversion causing a stronger dollar and lower oil prices. As investors became willing to accept more risk, this process was reversed - the dollar weakened and oil prices rose (both caused primarily by investors becoming less risk averse).

So is the weak dollar to blame for high oil prices? Though there is some impact, the data indicates that it plays a minor role at most.