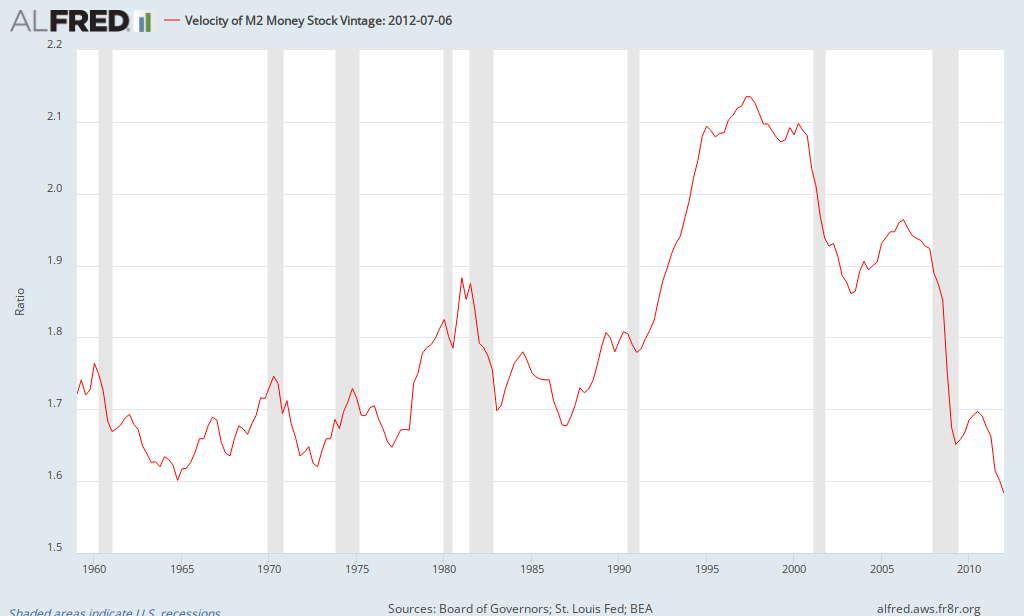

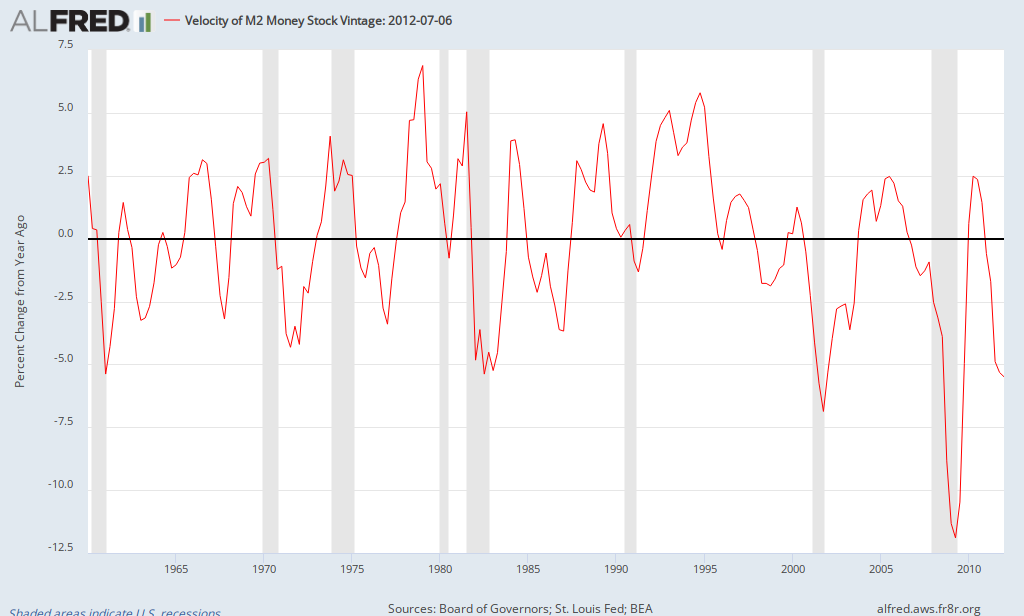

This post will primarily address the criticism that Fed policy is inflationary or has little impact by considering the role of velocity. To begin with, let's define a term that may be unfamiliar to most noneconomists, the velocity of money. Some classical economists used to assume that velocity was relatively constant, but this has not been the case in the last 50 years. Looking at either the chart above (showing velocity) or below (which shows the percent change in velocity), it's apparent that velocity tends to decline during recessions and rise during periods of more rapid economic growth (i.e., money gets used more during periods of strong growth).

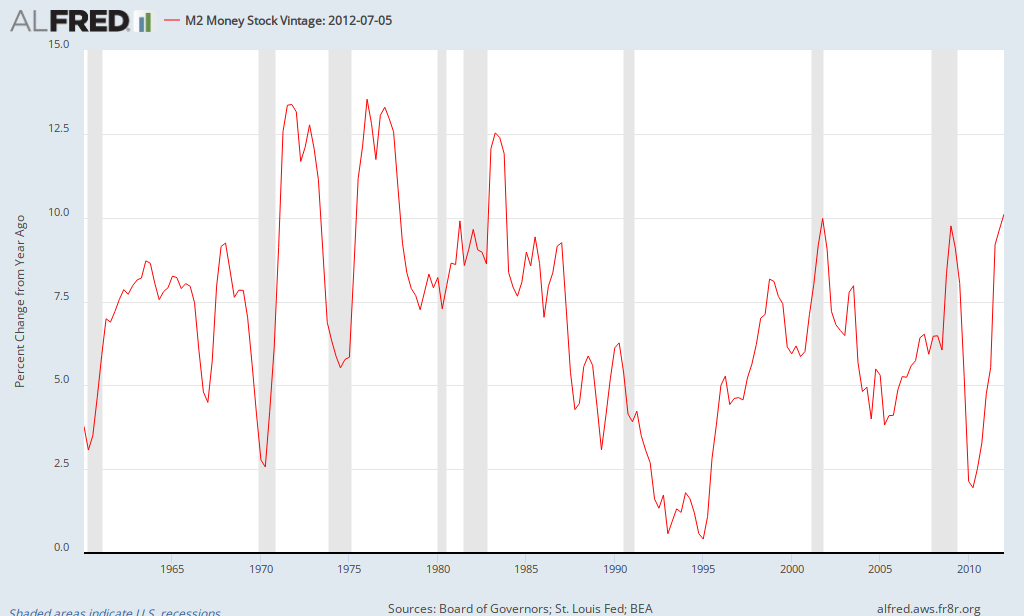

What happens if the velocity of money declines but the amount of money doesn't change? If the same amount of money is used less often, spending declines as does the economy. Thus, it's important for the Fed to increase the money supply to offset significant declines in velocity in order to stabilize the economy (note: it shouldn't micromanage small changes, but should intervene to offset singificant declines such as that seen in 2009 - see above). the following chart shows the behavior of the growth of the money supply in recent decades:

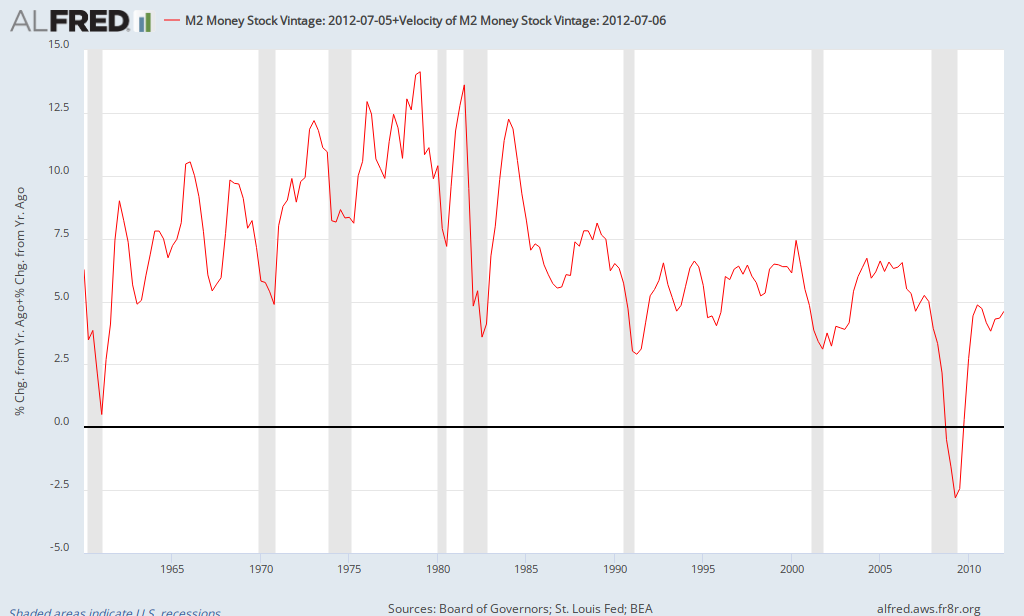

Thus, the Fed offset the large decline in the velocity of money in 2009 by increasing the money supply. When we add the two effects together, we obtain the following chart, which shows the demand for goods & services in the economy:

What do these charts show? In the late 1970s, the velocity of money was increasing by about 7%. The Fed did reduce the growth of the money supply, but not enough, allowing it to grow by 7.5%, resulting in a surge in demand and high inflation. Meanwhile, in 2009, velocity was plummeting and the Fed offset some of this decline, but the result was still declining demand of about 2.5%, resulting in declining inflation (and a temporary period of deflation in late 2008). Is current Fed policy inflationary? Given historical economic patterns, the answer is no. There hasn't been a period of high inflation when demand has been running at its current rate. It becomes an issue when its time for the Fed to implement its exit strategy. That is, when velocity begins to increase again, it will need to remove the stimulus in order to stabilize the economy and keep inflation in check.