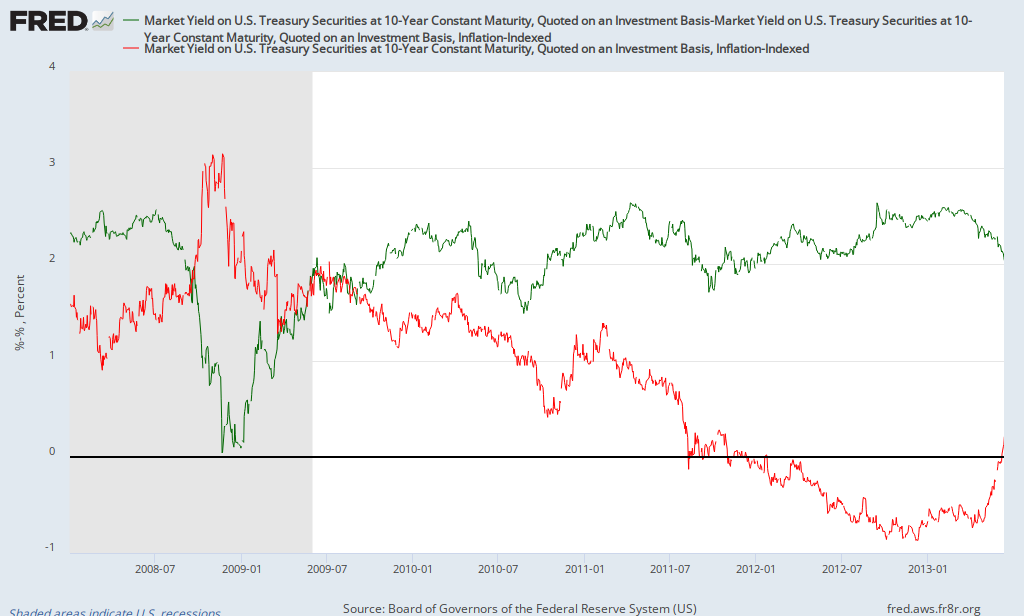

Why have interest rates risen recently? An increase in real interest rates. Here's a chart of the yield on ten-year TIPS (red line) and break-even inflation (green line) over the last 5 years (daily data):

While break-even inflation has declined recently, you'll notice that, after being negative since late 2011, the real interest rate just turned positive in recent days (and has risen significantly over the last month; from -0.68 at the end of April to 0.21 on June 12). What's the significance of the change in real interest rates? Here's an interesting chart of the S&P 500 (blue line) and the real interest rate as estimated by the yield on 10-year TIPS (green line):

Over the last 5 years, the correlation between the S&P500 and the yield on 10-year TIPS is -0.8; a strong negative relationship. The most likely explanation for it is low or negative real interest rates motivate investors to seek better returns elsewhere, including the stock market. Of course there are other factors that are affecting stock prices, but low/negative real interest rates due in part to QE seem to be having a significant impact. It appears that investors are right to be concerned about impact of the Fed scaling back QE. Of course, there's still considerable uncertainty as to when will begin to reduce its bond purchases as well as how quickly it'll phase out QE (will it go from $85 billion a month to $0 in a few months or over a much longer period of time).

In the five years before the financial crisis (June 2003-June 2008), the yield on 10-year TIPS averaged 2%. Though they won't necessarily rise back to that level, if real interest rates continue to normalize (rise somewhat), one can expect continued volatility in financial markets. It should be noted that the correlation between real interest rates and the stock market prior to the crisis (2003-2008) was small and slightly positive, so once real rates stabilize at a higher level, they should cease being a hindrance to the stock market.