In addition, the Fed has tried to limit its purchases of securities to short-term Treasuries to avoid introducing distortions to financial markets. In other words, buying mortgage-backed securities will artificially reduce mortgage rates until the Fed withdraws the stimulus sometime in the future (2015?). When that occurs, there's likely to be a higher than normal increase in interest rates (including mortgage rates) as rates rise from artificially low levels (in addition to increasing due to economic strenghening). At that point, lenders will have a considerable amount of mortgages with low interest rates locked in while they'll need to start paying higher rates on deposits. In addition, people with low mortgage rates will be somewhat reluctant to move, knowing that they'll have to pay a higher interest rate when buying a new house (of course many people will have to move for a new job, etc., but this will reduce the amount of "voluntary" moves).

Though lower interest rates increases the demand for loans, they may discourage lenders from making loans if it reduces the spread (lenders earn profits based on the difference between what they earn on loans and what they pay for funds). Smaller spreads may encourage lenders to focus on prime customers.

What about inflation? Prior to Ben Bernake's speech at the Jackson Hole conference on August 31, break-even inflation using 5-year TIPS was 1.92%. On Wednesday, September 12, it was 2.12% (Friday evening update: it rose to 2.39% on Friday; the highest since the summer of 2008; the break-even inflation rate using 10-year TIPS is 2.64%, the highest since 2006). Thus, in anticipation of QE3, expected inflation has risen somewhat (highest since May 2011). CPI inflation is running at 1.7% over the last 12 months while core CPI inflation is 1.9%, as close as you can get to the Fed's target of 2%. So unlike prior to QE1 and QE2, neither inflation nor break-even inflation is considerably below the 2% target (click here for details).

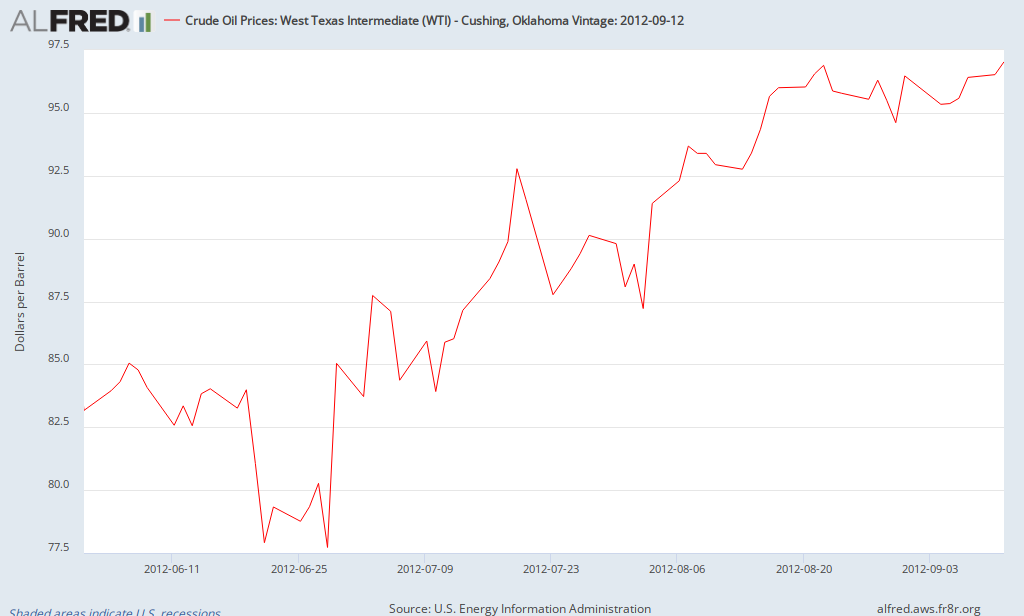

Is QE3 responsible for high oil prices? Not yet. Here's a chart showing the behavior of oil prices since June 2012:

As can be seen, most of the recent increase occurred prior to Bernanke's speech in Jackson Hole. Prior to the speech, oil sold for about $94.60 per barrel; as of Friday morning, September 14, it's $99.50 per barrel. Some of the increase can be attributed to turmoil in the Middle East while some is due to increased speculation due in part to QE3.

Clearly, there's a lot to be considered, but I'll address one last topic - the Fed's exit strategy. This was a hot topic about a year ago (the Fed even began to test methods that could be used to remove reserves in the future). Given the extraordinary size of the Fed's balance sheet, making it even large increases the complexity of any exit strategy. In other words, removing $3 trillion of excess reserves is more difficult than removing $2 trillion of excess reserves. Removal of excess liquidity needs to be done with care - not too soon (hurting the recovery) but not too late (increasing inflation). As mentioned earlier, distortions in financial markets resulting in artificially low rates will disappear when the Fed implements its exit strategy. The more the distortion, the harder the adjustment back to normal conditions (and the Fed is hoping for significant distortion in order for the policy to be effective).

Add it up and I think the costs exceed the benefits. If financial markets locked up again due to a European implosion or if fears of deflation started to take hold, additional QE would be justified. However, given sluggish growth (which is still growth), inflation close to its target, and the limited impact, I would not have voted for QE3.