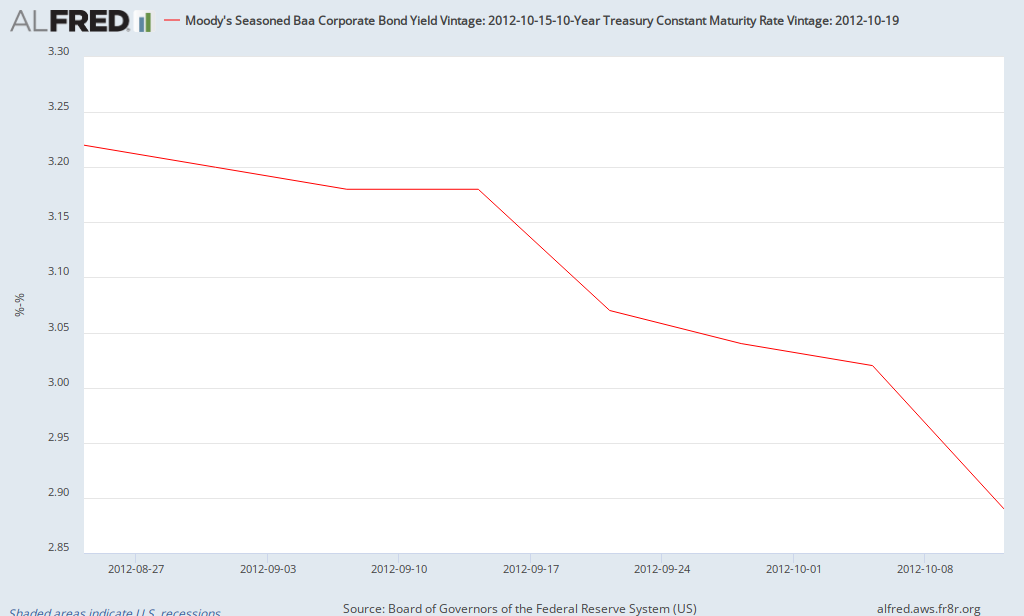

When was the last time it declined this much?

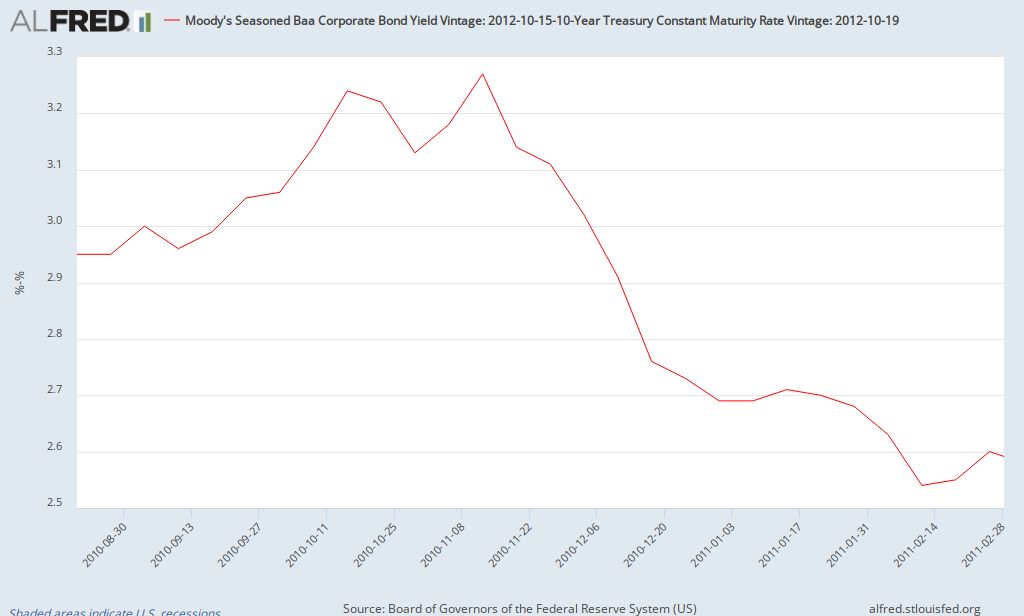

What was taking place during this period (Fall 2010 to early 2011)? QE2. Thus, there's evidence that QE2 helped the Baa risk premium to fall by about 0.75%. So far, QE3 has resulted in a decline in the risk premium of 0.5%. How long did the decline from QE2 last? It remained between 2.5% and 2.6% for most of the next 3 months before beginning to rise again in June 2011 (as QE2 came to an end).

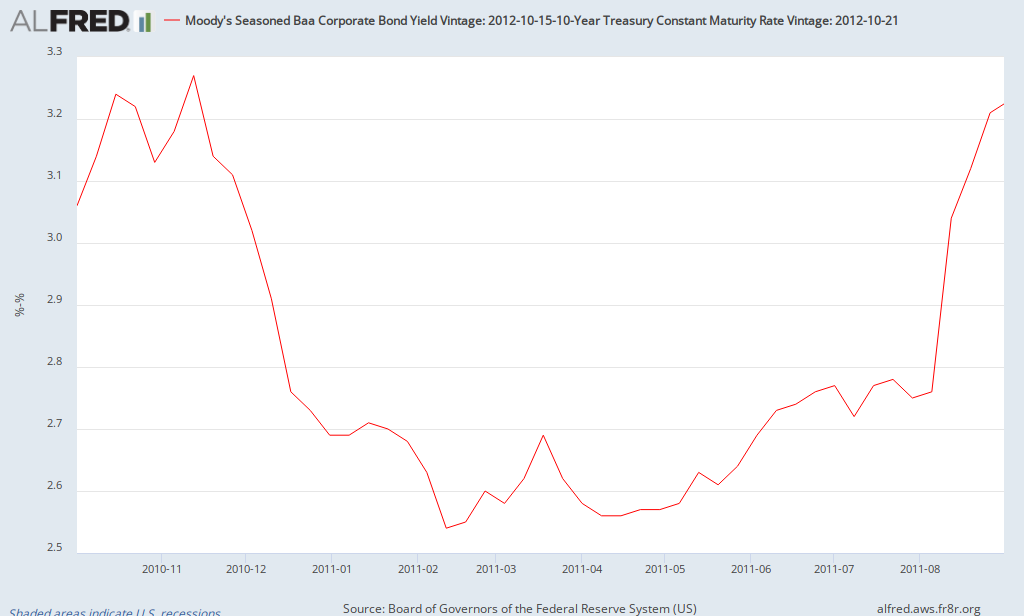

Update: Here's the rest of the story - a chart that shows the risk premium from the start of QE2 until the debt limit controversy of August 2011 (note: the risk premium was about 2.8% at the end of July 2011 before spiking in August 2011).

The Fed must be happy to see evidence of easing of credit so far due in part to QE3. Given the open endedness of QE3, will the risk premium continue to decline and remain relatively low (at least compared to recent times)? We'll have to wait and see.