What does the report suggest about the strength of the private sector? Here's a chart of final private demand over the last 5 years (includes consumption, fixed investment (not inventories), and net exports):

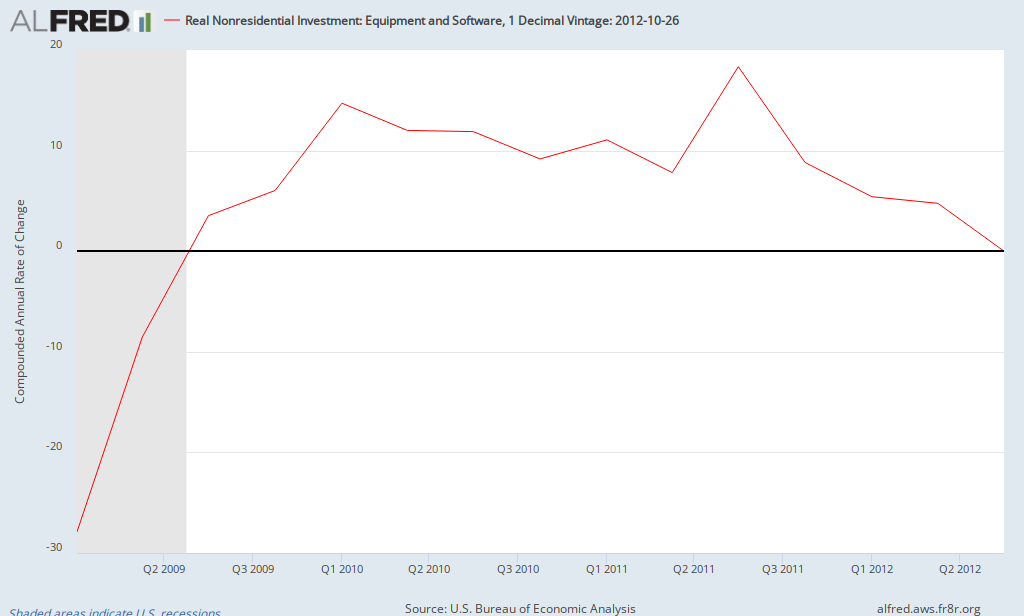

After posting a gain of 3% in the first quarter of 2012, the growth rate of private demand has declined to 1.9% in the second quarter and 1.4% in the third quarter (the lowest growth since the summer of 2010). Thus, while the the headline number showed slightly faster growth, the underlying strength of the private sector seems to be slipping.A major reason for this slowdown is the weakness of business investment in equipment and software:

After growing at about a 10% rate in 2010 and 2011 and 5% in the first half of 2012, investment in equipment and software was flat (tiny negative) in the third quarter, the weakest performance since the Spring of 2009 (at the end of the recession). In addition, exports declined for the first time since the first quarter of 2009, reflecting the global economic slowdown.

What's the takeaway? The economy continues to struggle, still growing but at a low rate with some signs of increasing weakness in the private sector.