What's happened to expected inflation? Prior to Bernanke's speech in Jackson Hole, Wyoming, during which he indicated the likelihood of QE3, break-even inflation according to the 5-year TIPS was 1.92%. The day after QE3 was announced, it stood at 2.39% (the highest since summer 2008). Two weeks later, it's back down to 2.11%. Thus, as of now, market participants aren't worried about a significant increase in inflation resulting from QE3.

Another gauge of financial conditions that I like to look at is the risk premium on Baa corporate bonds, a measure of the perceived risk of relatively safe companies. Prior to Bernanke's speech, it stood at 3.2%. The day before the announcement, it was 3.18%; now it's 3.05% (down from a summer 2012 high of 3.46%). The last time it was consistently below 3% was in early August 2011 (prior to the debt limit debacle). What's normal? Risk premiums of 2% or less were common before the financial crisis (it rose past 6% during the worst part of the crisis). Is the recent decline due to QE3? There are probably several factors, but the Fed would be happy to reduce the cost of credit for businesses (and consumers), helping to provide support for a stronger recovery.

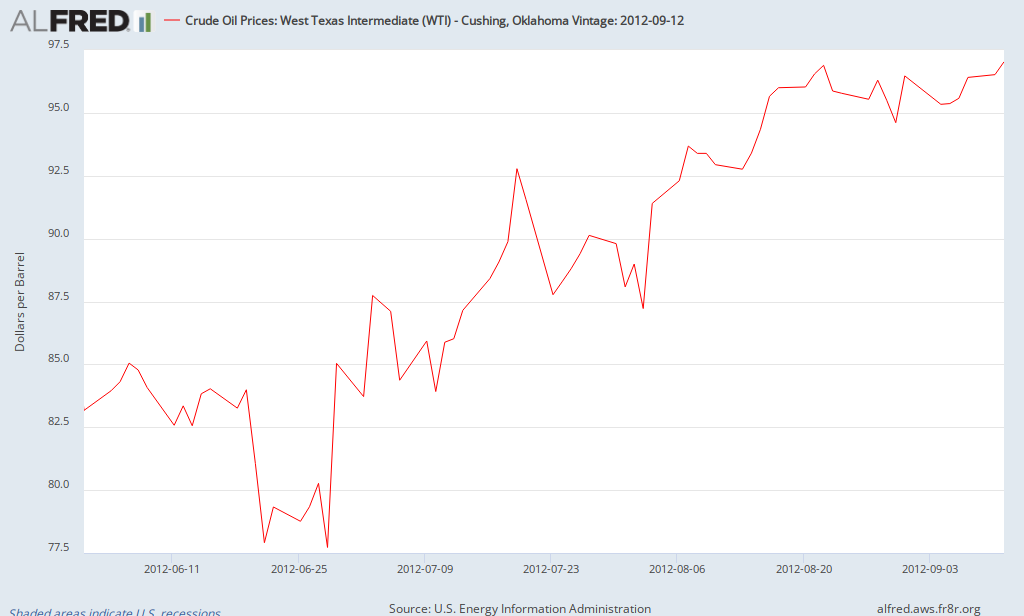

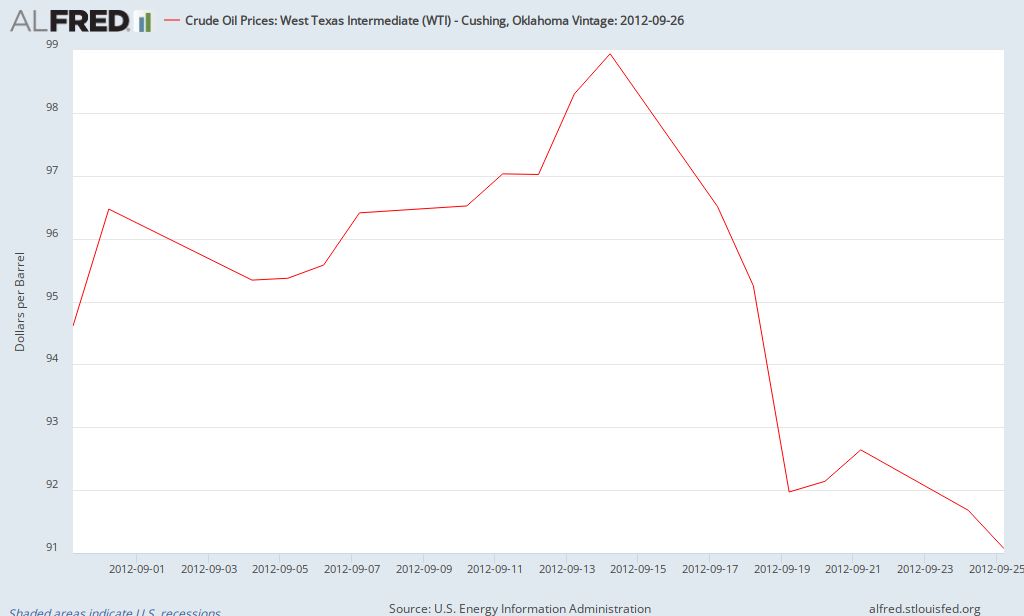

What about oil prices? Prior to Benanke's speech, the price of a barrel of West Texas Oil was $94.60; it rose to almost $100 per barrel the day after QE3 was announced. Currently, it's about $92 per barrel.

Of course it's too early to draw conclusions, but so far it's hard to find evidence of a noticeable change in inflation or inflationary expectations as a result of QE3.